Condo Insurance in and around Orlando

Condo unitowners of Orlando, State Farm has you covered.

Cover your home, wisely

Home Is Where Your Heart Is

Because your condo is your retreat, there are some key details to consider - location, home layout, neighborhood, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you great insurance options to help meet your needs.

Condo unitowners of Orlando, State Farm has you covered.

Cover your home, wisely

Safeguard Your Greatest Asset

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has plenty options to keep your condo and its contents protected. You’ll get coverage options to correspond with your specific needs. Thankfully you won’t have to figure that out alone. With empathy and terrific customer service, Agent Brandon Quarterman can walk you through every step to help generate a plan that shields your condo unit and everything you’ve invested in.

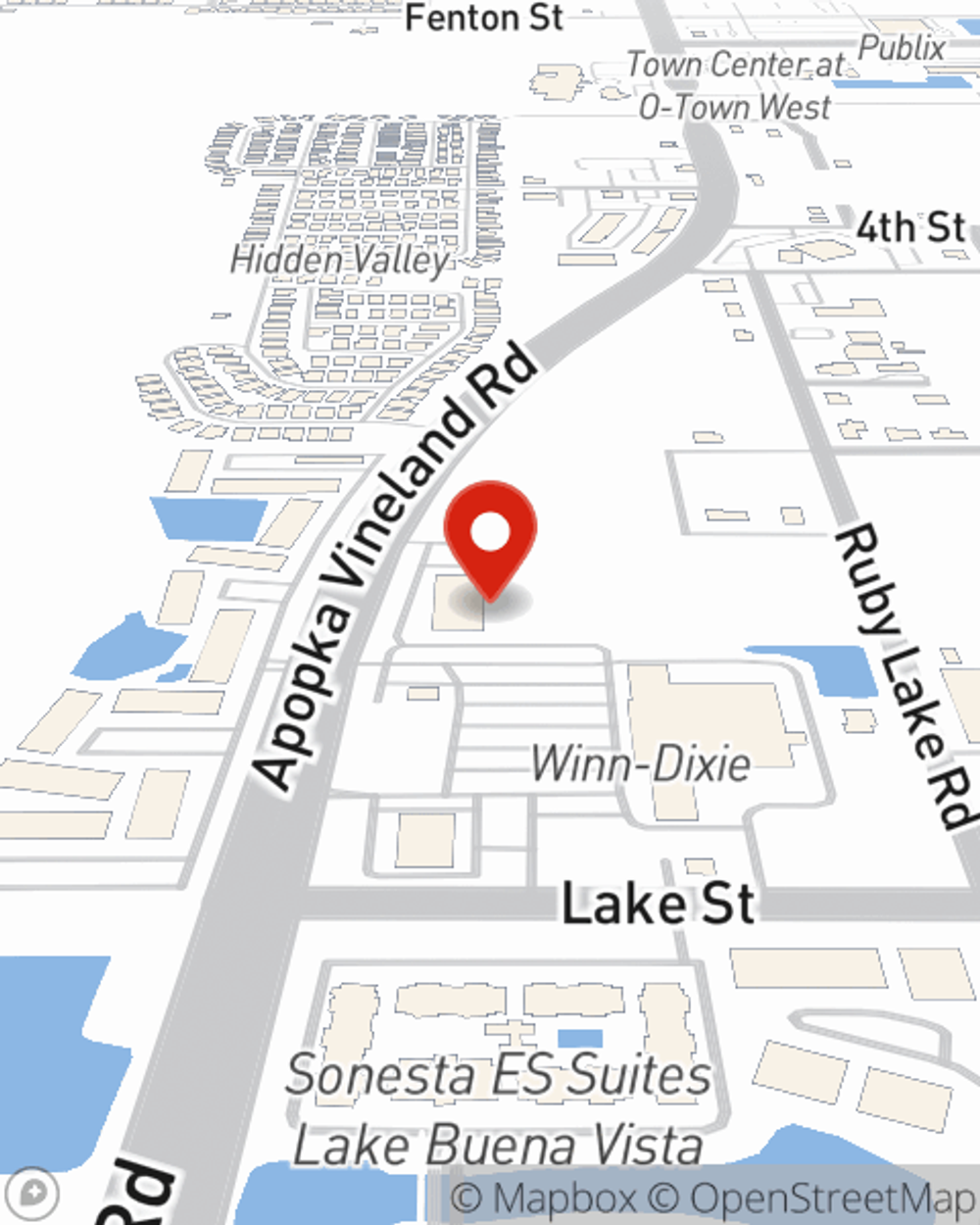

Orlando condo owners, are you ready to learn more about what the State Farm brand can do for you? Call or email State Farm Agent Brandon Quarterman today.

Have More Questions About Condo Unitowners Insurance?

Call Brandon at (407) 578-9130 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Brandon Quarterman

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.